|

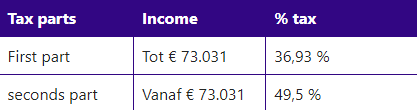

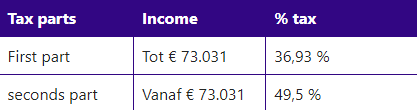

You have to pay tax on your income. The amount you have to pay in income tax depends on the amount of your income and assets.

Income tax is divided into three so-called boxes, each for a different type of income.

You don't pay it all at once but the employer (BAM Works) has to pay this already to the government. This is a kind of 'advance' that you pay on your taxes. Every employee can check this on his pay slip. In Dutch this is called: "Loonheffing".

Example 1:

If you earn €70.000,- a year you pay 36,93% tax= €25.851,-

Example 2:

If you earn €90.000,- a year you pay:

€73.031,- x 36,93%= €26.970,-

€90.000 - €73.031= €16.969,- x 49,5%= €8.399,-

Total: €26.970,- + €8.399,-= €35.369,

|